On This Page

- Lone Peak’s Promise: Our Commitment To You

- Important Dates

- Benefits Eligibility

- Company-Sponsored Benefits

- How to Enroll, Make Changes, or Renew Your Benefits

- Meet Nayya: Your AI Benefits Helper

- Resources

Lone Peak’s Promise: Our Commitment To You

At Lone Peak, we believe in offering support so you can focus on what matters most—providing exceptional care for kiddos and their families. We are committed to offering competitive, high-quality benefits that support your health, well-being, and financial security.

This year’s benefits reflect an 8% increase in cost, aligning with broader industry trends. In keeping with our commitment to team members, Lone Peak is absorbing half of that increase to ease the impact on you. This means that while costs have risen, your contribution will only increase by 4%, allowing you to continue accessing comprehensive benefits at a more manageable cost.

We know that investing in you is the key to our collective success. That’s why we remain dedicated to providing meaningful benefits that support you and your loved ones—because when you thrive, so does our community.

Important dates

Open Enrollment Period 04/14-04/28

Open Enrollment Orientation Calls:

Benefits Eligibility

At Lone Peak, we strive to provide benefits that support the well-being of our employees and their families. Eligibility for benefits is based on your employment status:

- Full-Time Employees (30+ hours per week): Eligible to enroll in all employer-sponsored benefits, including medical, dental, vision, life insurance, disability, and other core benefits.

- Part-Time Employees (Less than 30 hours per week): Eligible to enroll in voluntary benefits, such as supplemental life insurance, accident coverage, and other optional offerings.

Company-Sponsored Benefits

At Lone Peak, we are committed to supporting our employees by providing essential company-sponsored benefits at no additional cost to you.

- Short-Term Disability (STD): Provided to all full-time employees (30+ hours per week) to offer financial protection in the event of a temporary disability.

- Long-Term Disability (LTD): Provided to full-time employees who enroll in a medical plan, ensuring extended financial support if a serious health condition prevents you from working long-term.

- Life Insurance: All full-time employees receive a $25,000 company-paid life insurance policy for added peace of mind and financial security for your loved ones.

These benefits reflect our commitment to your well-being and financial protection, giving you added security while you focus on what matters most.

How to Enroll, Make Changes, or Renew Your Benefits

- Log into ADP on your desktop, or open the ADP Mobile App.

- On Desktop:

- Click the Benefits tile on the home screen OR

- Navigate to Myself Tab > Enrollments

- On the ADP Mobile App:

- On the ADP Mobile App:

Download for iPhone | Download for Android - Click on Benefits to view, enroll, or make changes.

- On the ADP Mobile App:

- On Desktop:

Make sure to complete your enrollment by 4/28 to secure your coverage for the upcoming plan year.

Meet Nayya: Your AI Benefits Helper

Choosing the right benefits can feel overwhelming—but you don’t have to do it alone! Nayya is here to help.

What is Nayya?

Nayya is your AI-powered benefits assistant, designed to guide you through your enrollment decisions by answering your questions, comparing plan options, and helping you make the best choices for your needs.

How Can Nayya Help?

- Provides personalized recommendations based on your healthcare needs and financial goals.

- Answer common benefits questions to help you understand your options.

- Assists with navigating medical, dental, vision, and voluntary benefits to ensure you get the coverage that’s right for you.

You can access Nayya directly through the ADP benefits portal during enrollment. Let Nayya take the guesswork out of benefits so you can enroll with confidence!

Resources

- FAQ

- Total Rewards Guide

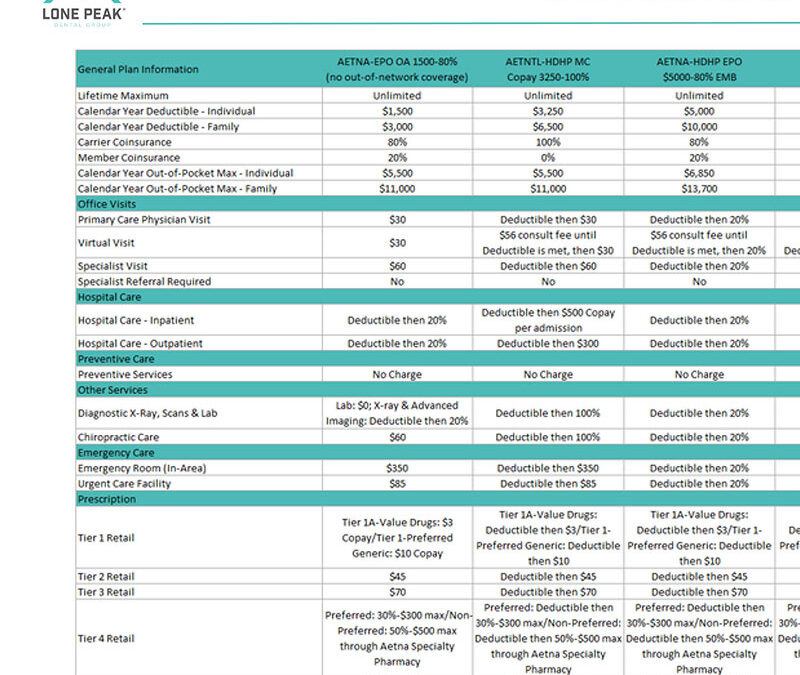

- Comparison Sheet

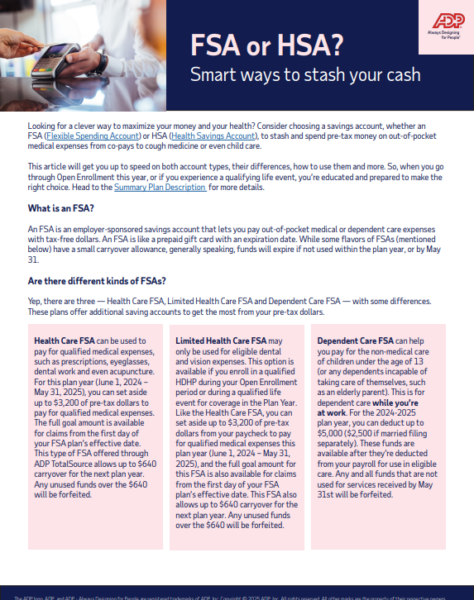

- Benefit Bites are quick, digestible content to educate you on the benefits you have available through ADP TotalSource. Visit the below links for more information!

- What Are Benefit Bites?

- Open Enrollment & Qualifying Events

- MyLife Advisor

- EPO Vs. PPO

- HSA Vs. FSA

- Dependent FSA

- Dependents

- Short & Long Term Disability Coverage

- Part-Time Employee Benefits

- Dental & Vision

- EAP & Employee Discounts

- Deductibles

- Nayya: AI-Powered Benefits Assistant

- Pet Insurance

- Maven Fertility Benefits

- Mental Health Benefits